2023-08-10

On the Way to Climate-Neutral Buildings: Regulations and Success Factors

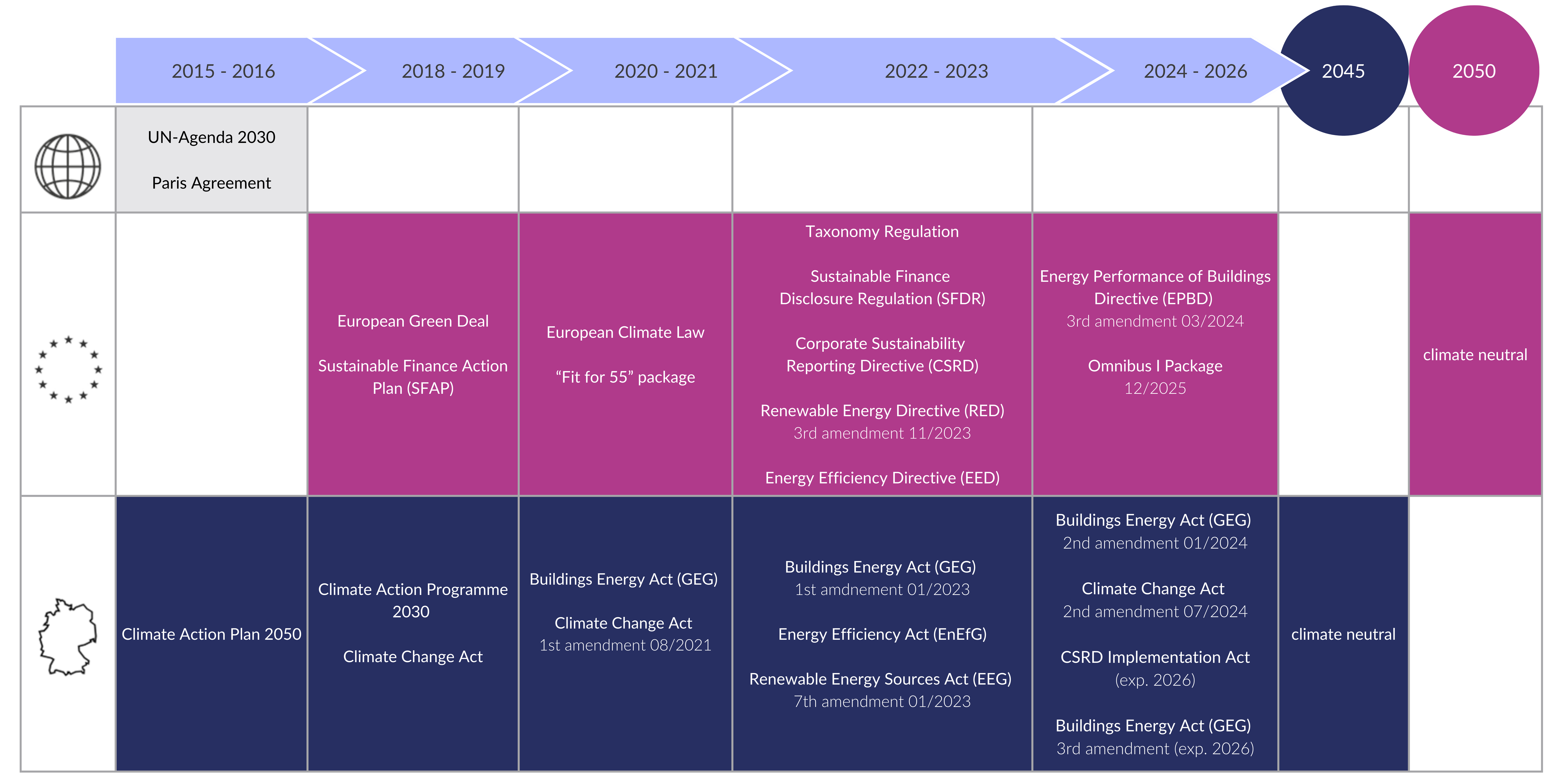

The importance of sustainability in the real estate industry has grown significantly in recent years due to climate change and the need to conserve resources. These factors are forcing the industry to move towards sustainable practices. The significant environmental impact of the building sector not only creates a moral obligation to take action, but also faces increasing regulatory pressure.

The Paris Agreement and the European Green Deal

To meet the commitments of the UN's Agenda 2030 and the Paris Agreement, the European Union has set ambitious targets in the “European Green Deal”, including:

- reducing emissions by at least 55 % by 2030,

- becoming the first climate neutral continent by 2050.

The European Climate Law has turned these targets into legal obligations, making them mandatory - and the building sector is seen as a key player in achieving these goals. According to the Climate Law, all new buildings must be CO2 neutral by 2030 in order to meet the climate targets. This requirement will be extended to all existing buildings from 2050. In 2021, Germany strengthened its federal Climate Change Act again, moving the final target of net greenhouse gas neutrality from 2050 to the more ambitious target of 2045.

The Energy Performance of Buildings Directive (EPBD) and the Buildings Energy Act (GEG)

To ensure that EU member states comply with European climate legislation, the "Fit for 55" package includes several proposals to revise and update specific EU legislation. This includes the Energy Performance of Buildings Directive (EPBD), which directly affects the German Buildings Energy Act (GEG). The directive, which was amended in March 2024, aims to make zero-emissions the standard for new buildings by 2030. For public authorities and other public institutions, this target will apply from 2028.

In addition to residential buildings, the amended directive also provides for gradual improvements for non-residential buildings through minimum energy performance standards (MEPS). According to the "worst first" principle, the 16 % of existing non-residential buildings with the worst carbon footprint must be renovated as a priority by 2030. In addition, member states must develop concrete measures to completely phase out the use of fossil fuels for heating and cooling their buildings by 2040.

New Building Automation Requirements From January 1, 2025

According to the EPBD, by the end of 2024, non-residential buildings with a heating or cooling capacity of more than 290 kilowatts must also be equipped with a building automation and control system that meets certain minimum requirements for data availability and consumption monitoring and optimization by the end of 2024.

In Germany, this obligation has already been implemented into national law with the amendment of the GEG in January 2024. From 2030, the EPBD, as amended in 2024, will require this for systems with a rated output of more than 70 kilowatts. The revised directive must be transposed into national law by the member states within two years.

The Renewable Energy Directive (RED) and the Renewable Energy Sources Act (EEG)

The Renewable Energy Directive (RED), together with the Energy Efficiency Directive (EED) and the Energy Performance of Buildings Directive (EPBD), is part of the EU’s major climate policy initiative "Fit for 55". This initiative increases the binding target for the share of renewable energy in the EU's total energy consumption from 32 % to 42.5 % by 2030. In addition, Member States have agreed on a non-binding target of 45 % renewable energy in the final energy consumption of the buildings sector.

In Germany, the RED is implemented through the Renewable Energy Sources Act (EEG). The 2023 amendment is described as the "biggest energy policy reform in decades" and is intended to increase the share of renewable energy in gross electricity consumption to at least 80 % by 2030.

The Energy Efficiency Directive (EED) and the Energy Efficiency Act (EnEfG)

The Energy Efficiency Directive (EED), like the Renewable Energy Directive (RED) and the Energy Performance of Buildings Directive (EPBD), is part of the European "Fit for 55" package and also addresses key aspects of the building sector. The tools include advanced metering technologies and greater transparency of energy consumption, enabling targeted energy savings and reductions in CO2 emissions. The EED must be transposed into national law in all member states.

In Germany, this is done through the Energy Efficiency Act (EnEfG), which serves as across-sectoral framework for energy savings. The law sets energy efficiency targets for primary and final energy by 2030. Companies with an average annual consumption of more than 7.5 GWh in the last three completed calendar years are required to implement an energy management system in accordance with DIN EN ISO 50001 or an environmental management system in accordance with EMAS (Eco Management and Audit Scheme).

The Federal Ministry for Economic Affairs and Climate Action (BMWK) is currently planning extensive amendments to the EnEfG. The proposed changes would significantly weaken key provisions. For instance, the national final and primary energy efficiency targets for 2030 and 2045 are to be completely removed, and the consumption threshold for the obligation to implement an energy management system (EnMS or EMAS) under is to be raised from 7.5 GWh to 23.6 GWh of final energy consumption per year. The draft is currently still under inter-ministerial coordination.

The Taxonomy Regulation and the Sustainable Finance Disclosure Regulation (SFDR)

The Taxonomy Regulation, as well as the Sustainable Finance Disclosure Regulation (SFDR), are at the heart of the European Sustainable Finance Action Plan (SFAP) and have already been applied in the relevant sectors since the beginning of 2022. It defines which economic activities are considered environmentally sustainable, allowing investors to align their capital investments accordingly. Transparency obligations and the implementation of sustainability standards apply not only to the acquisition and ownership of new buildings, but also to the renovation of existing buildings and certain modernization measures.

The Taxonomy Regulation is currently non-binding and does not (yet) specify therequired number of compliant buildings that a fund must include to be considered sustainably managed overall. However, the timeline for implementation of national and international regulations is tightly planned, and it is likely that additional innovations will emerge in the coming years.

Outlook: Environmental and Social Sustainability as an Investment Criterion

While the ESG framework encompass social concerns and responsible corporate governance, the current EU taxonomy focuses solely on environmental sustainability aspects, such as a property's energy consumption. Meanwhile, an EU expert group has proposed a first set of guidelines for classifying socially sustainable economic activities, which are intended to complement the environmental taxonomy. For example, a requirement to meet certain comfort standards in a building could be relevant to commercial real estate.

The Corporate Sustainability Reporting Directive (CSRD)

Another key pillar of the “European Green Deal” is the Corporate Sustainability Reporting Directive (CSRD) which came into force in 2023. Companies subject to reporting requirements will have to publish comprehensive mandatory information for their annual sustainability statement in a management report.

Key Changes Introduced by Omnibus I

On December 16, 2025, an agreement was reached at the EU level on the Omnibus I package, which fundamentally restructures the requirements for sustainability reporting. Originally, the number of companies subject to reporting obligations in Germany was expected to increase from around 500 to approximately 15 000 – and up to 50 000 across Europe. However, Omnibus I has reduced the scope of application. For example, only companies with more than 1 000 employees AND an annual net turnover exceeding €450 million are now subject to mandatory CSRD reporting. Capital market-oriented SMEs are fully exempt. Overall, these adjustments reduce the previous group of obliged entities by about 90%.

Since the CSRD has not yet been transposed into national law in Germany – and will not be before December 31, 2025 – the Non-Financial Reporting Directive (NFRD) still applies. This 2014 EU directive required large companies to disclose non-financial information, particularly relating to environmental, social, human rights, and governance (ESG) aspects. Capital market-oriented companies with more than 500 employees must therefore continue to submit a non-financial statement under the German Commercial Code (Handelsgesetzbuch) for the 2025 financial year. It is expected that the revised CSRD will be transposed into German law in the course of 2026.

The real estate sector in EU member states will also face increased transparency obligations under the CSRD – albeit to a considerably lesser extent than originally planned. Nevertheless, intelligent data management remains a key success factor for any real estate company subject to reporting obligations, particularly for large portfolio owners that exceed the new thresholds.

Four Reasons to Act Now

Whether you are a real estate fund company, project developer, asset or property manager, the entire real estate value chain is directly or indirectly affected by these developments:

- Market Value: Buildings that do not meet sustainability criteria are at risk of devaluation and may become unattractive to potential investors as so-called “stranded assets”.

- Stakeholder Benefits: Financial institutions encourage sustainable investments by offering more attractive financing terms.

- Cost Efficiency: Decarbonizing building operations pays off financially by reducing operating costs and increasing energy efficiency.

- Regulatory Compliance: The constant evolution at both European and national levels will require increased action from the real estate sector in the coming years.

Now Is the Time to Invest in the Future!

- Check the compliance of your assets and plan for necessary adjustments.

- Collect sustainability data and present it transparently.

- Implement measures to effectively reduce the environmental impact of your assets.

- Leverage financial incentives through a carefully designed funding strategy.

Towards Carbon-Neutral Buildings With Data-Driven Operational Optimization

At aedifion, we believe that data and its analysis are a central element of a climate-neutral building stock. Our expertise in engineering and information technology is aimed at asset managers and owners who want to quickly and easily decarbonize their portfolios. Our AI-based cloud platform can reduce building energy consumption, CO2 emissions and operating costs by up to 40 %.

In addition, we support the collection of sustainability data for ESG reporting and compliance with national legal requirements, such as the German Buildings Energy Act (GEG). This law mandates the installation of building automation and control systems, as well as digital energy monitoring technology, for existing non-residential buildings above a certain HVAC rated capacity. In doing so, we contribute to sustainable value creation and future-proof your property.

Note: Our research and assessments are based on the current state of the law and do not constitute valid legal advice.

Buildings Simply Made Better

Get in Touch With US!

In a one-on-one meeting, we will clarify your specific requirements and demonstrate how our AI-based cloud solutions and service packages can benefit you.